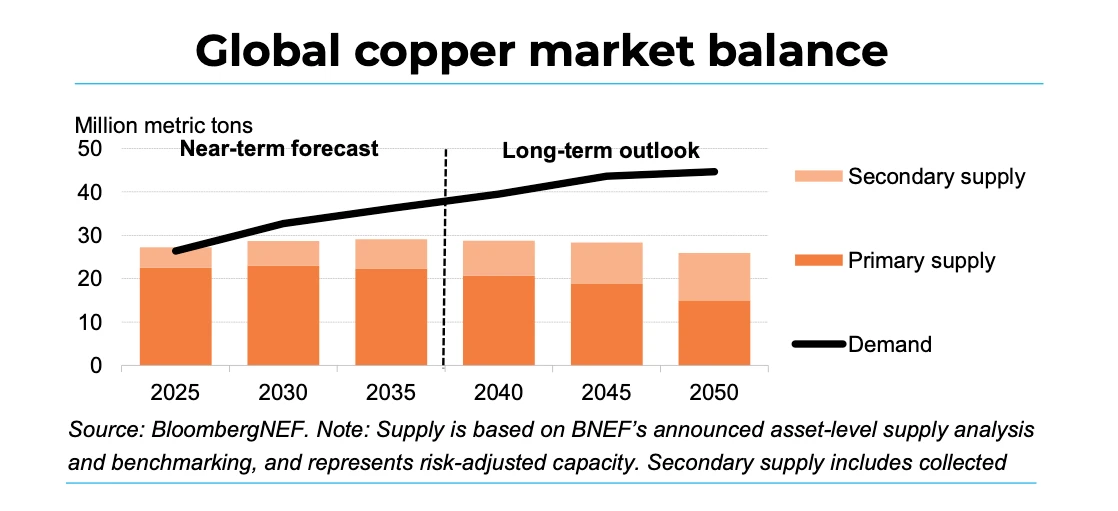

According to a recent analysis by BloombergNEF, the global copper market is heading toward a structural supply deficit, not a temporary shortage driven by market speculation or short-term price cycles.

Structural Deficit Expected From 2026 Onward

The report indicates that from 2026 onward, global copper supply will struggle to keep pace with steadily rising demand. This imbalance is expected to persist long term, making the upcoming shortage structural in nature rather than cyclical.

Energy Transition Is Driving Demand

The primary driver of copper demand growth is the global energy transition. Expanding power grids, renewable energy projects, electric vehicles, and the rapid growth of data centers are significantly increasing copper consumption.

BloombergNEF’s Transition Metals Outlook 2025 forecasts that copper demand linked to energy transition technologies could triple by 2045, placing unprecedented pressure on supply chains.

New Supply Is Lagging Behind

On the supply side, new copper projects are not coming online fast enough. Long development timelines, permitting delays, declining ore grades, and underinvestment have slowed production growth. In addition, operational disruptions in major copper-producing countries such as Chile, Peru, and Indonesia have further constrained supply.

Recycling Alone Will Not Close the Gap

While copper recycling is expected to grow, BloombergNEF notes that secondary supply will not be sufficient to offset the projected deficit. Without major investment in both new mining projects and recycling infrastructure, the copper market could face a cumulative shortfall of up to 19 million tonnes by 2050.

Market Impact and Prices

Copper prices have already reflected tightening fundamentals, rising sharply in 2025 and approaching one of the strongest annual performances since 2009. Analysts emphasize that this price rally is supported by structural market fundamentals, not speculative hype.

What Needs to Happen

To prevent long-term supply shortages, the report highlights the need for:

- Increased investment in new copper mining projects

- Faster permitting and development timelines

- Significant expansion of copper recycling capacity

Conclusion

The analysis makes it clear that copper’s future shortage is real and structural. Without coordinated action across mining investment, policy, and recycling, the gap between supply and demand will continue to widen — with long-term implications for global energy transition and industrial growth.

.j_s_thumb.webp)